td ameritrade tax withholding

Person your allocable share of any partnership income from a US. Im rolling some cash from my traditional IRA into my Roth and one of the fields is for Tax Withholding Election for federal withholding and then state.

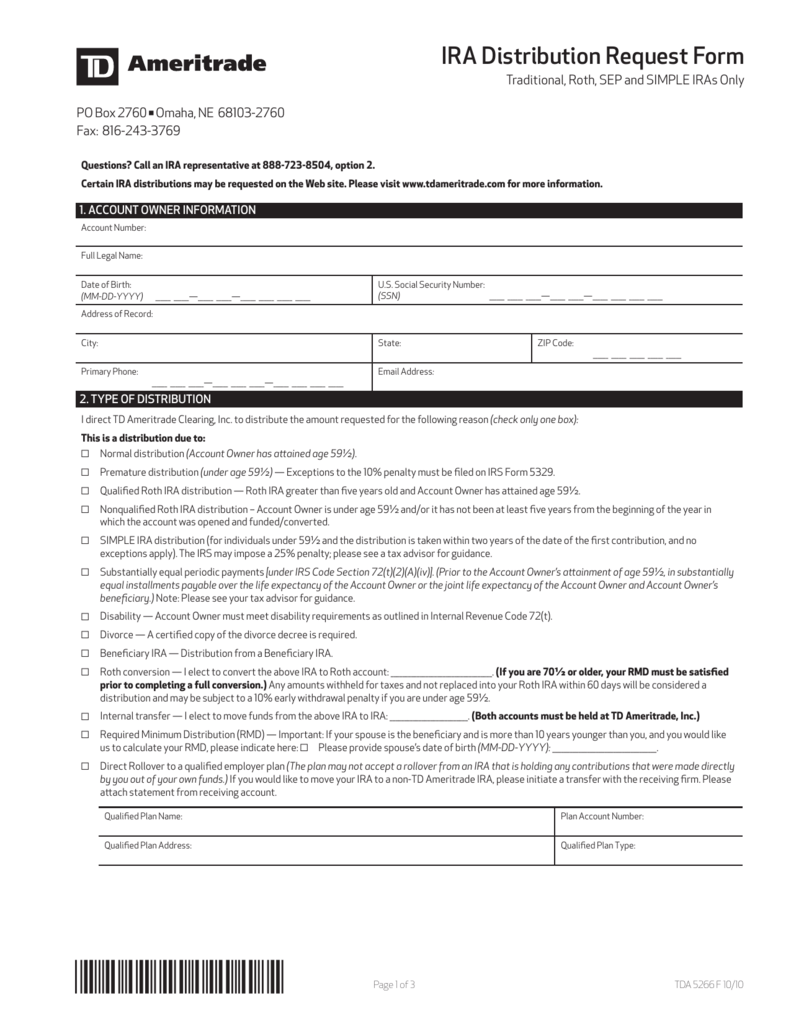

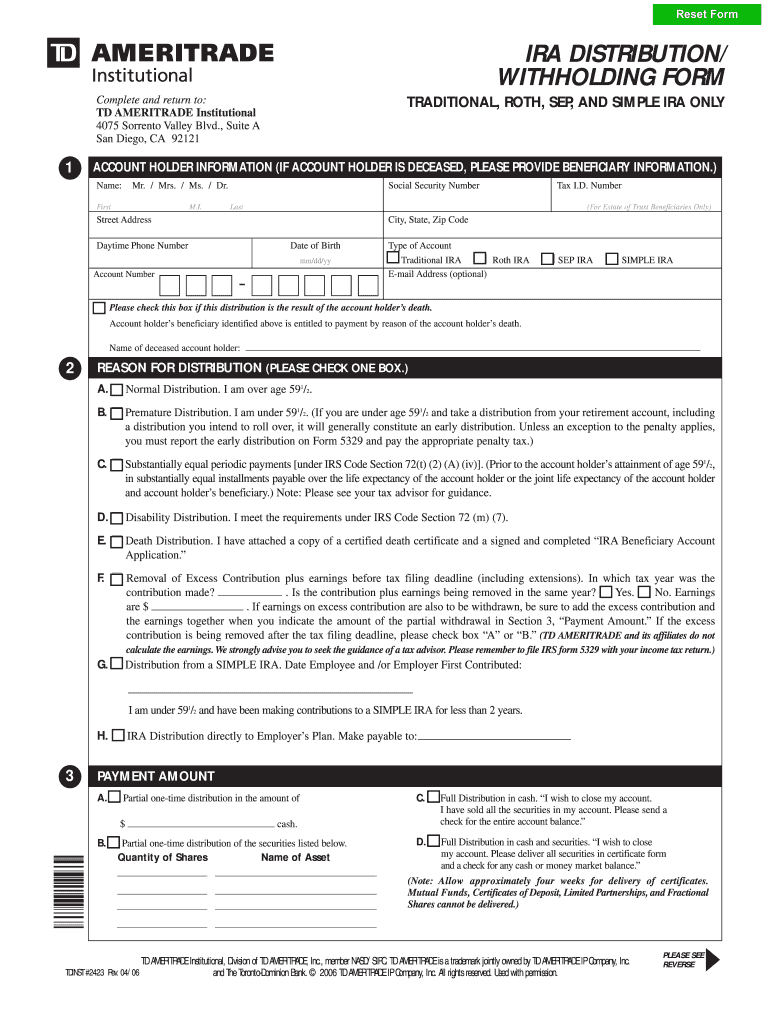

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

Continue your return in TurboTax Online.

. Holding period requirements that must be met to be eligible for this lower tax rate. Mailing date for Form 1042-S and Real Estate Mortgage Investment ConduitWidely Held Fixed Investment Trust REMICWHFIT. TD Ameritrade Clearing Inc.

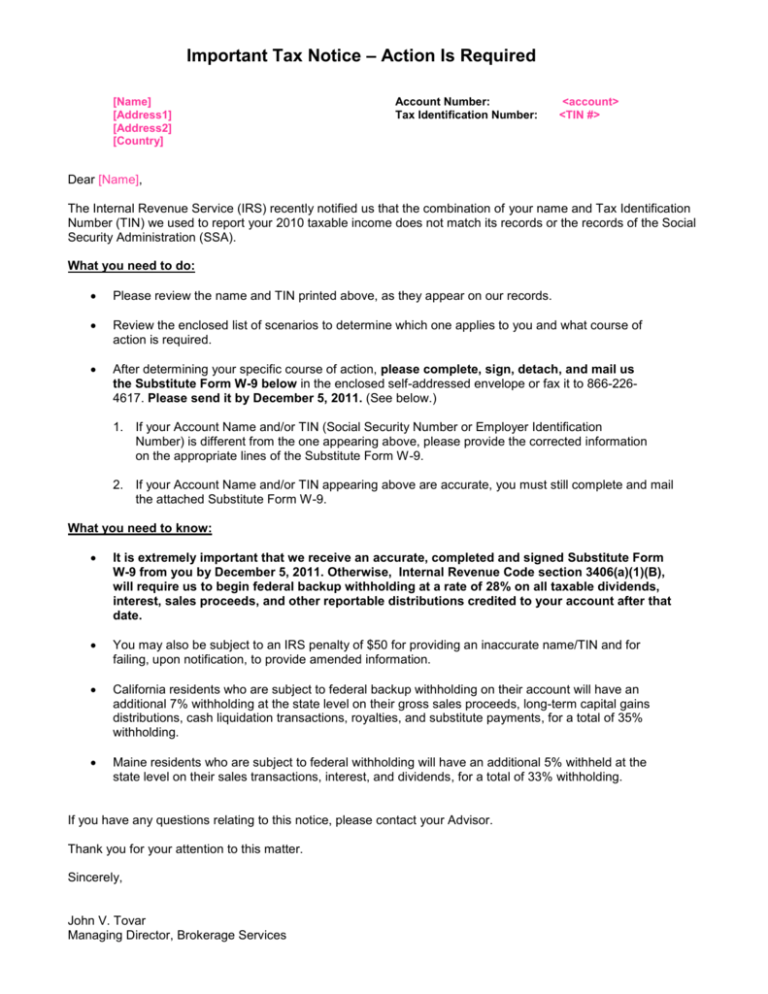

TD Ameritrade Clearing Inc. I recently opened an account with TD Ameritrade. Claim exemption from backup withholding if you are a US.

You must enter the gain or. Using TD Ameritrade Taxes. If you trade with TD Ameritrade the withholding agent is TD Ameritrade.

If applicable you are also certifying that as a US. Alternatives to Splurging If you opt to receive more money in each paycheck you could. Is required by federal andor state statutes to withhold a percentage of your IRA distribution for income tax purposes.

If electing a partial distribution State income tax will be withheld only. Withholding agents are personally liable for any tax required to be withheld. TD Ameritrade provides information and resources to help you navigate tax season.

TD Ameritrade will report a dividend as qualified if it has been paid by a US. You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program. TD Ameritrade charges 4999 to buy or sell any no-load mutual funds not on its no-transaction-fee list.

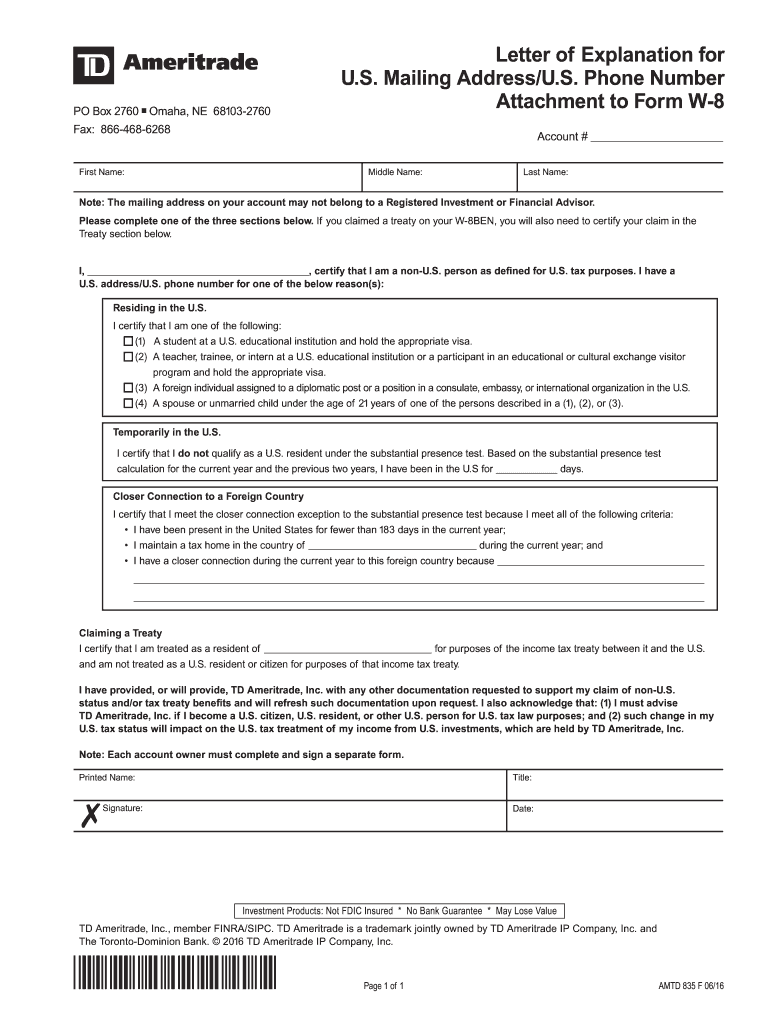

If you do not make an election District of Columbia requires that withholding be taken at the minimum rate of 1075. Withholding will apply to the entire withdrawal since the. Of the treaty identified on line 9 above to claim a rate of withholding on specify type of income.

Access a Depth of Elite Tools Available in our thinkorswim trading Platforms. TD AMERITRADE - On page 2 of the tax document they sent me Summary Of Proceeds Gains Losses And Tax Withheld They show a Gross Proceeds Grand total of. E-Trade charges 1999 for buying or selling any funds not on its no-transaction fee.

Tdameritrade PDF Tax Withholding Update Form-TDA 0421 - TD Ameritrade Td ameritrade charges 999 no matter what type of trade you put. If your return isnt open. This is Non-Resident Alien NRA withholding that is withheld by TD Ameritrade Singapore and sent to the US.

Taxpayer with at least 10 in dividend income youll receive a 1099-DIV form from TD Ameritrade along with a consolidated 1099 form. Access a Depth of Elite Tools Available in our thinkorswim trading Platforms. Explain the additional conditions in the Article and paragraph the beneficial owner.

State Withholding If you change the state of residence listed on your account you will be responsible for any state withholding tax implications. If youre a US. This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few.

Any withdrawal from your Custodial IRA is subject to federal income tax withholding unless you elect not to have withholding apply. In some cases you may elect not. You should have received your 1099 and 1098 forms.

Your tax forms are mailed by February 1 st. Short Term gain and Short Term Loss Tax. Internal Revenue Service IRS on your behalf so no additional.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. Mailing date for Forms 4806A and 4806B. 1099-INT forms are only sent out if the interest earned is at least 10.

Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th-largest US. Or qualified foreign corporation.

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Logo Td Ameritrade Institutional

Fill Free Fillable Td Ameritrade Pdf Forms

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

How To Register A Td Ameritrade Account In Malaysia Marcus Keong

Fill Free Fillable Td Ameritrade Pdf Forms

Tda186 Pdf Pdf Concurrent Estate Investor

Fill Free Fillable Td Ameritrade Pdf Forms

How To Read Your Brokerage 1099 Tax Form Youtube

How To Sign Up For A Td Ameritrade Brokerage Account A Step By Step Guide Nasdaq

Fillable Online View Td Ameritrade Fax Email Print Pdffiller

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

How To Register A Td Ameritrade Account In Malaysia Marcus Keong

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Do Non Us Citizens Need Itin To Trade Stocks On Td Ameritrade And Enjoy Earning From That Quora

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms